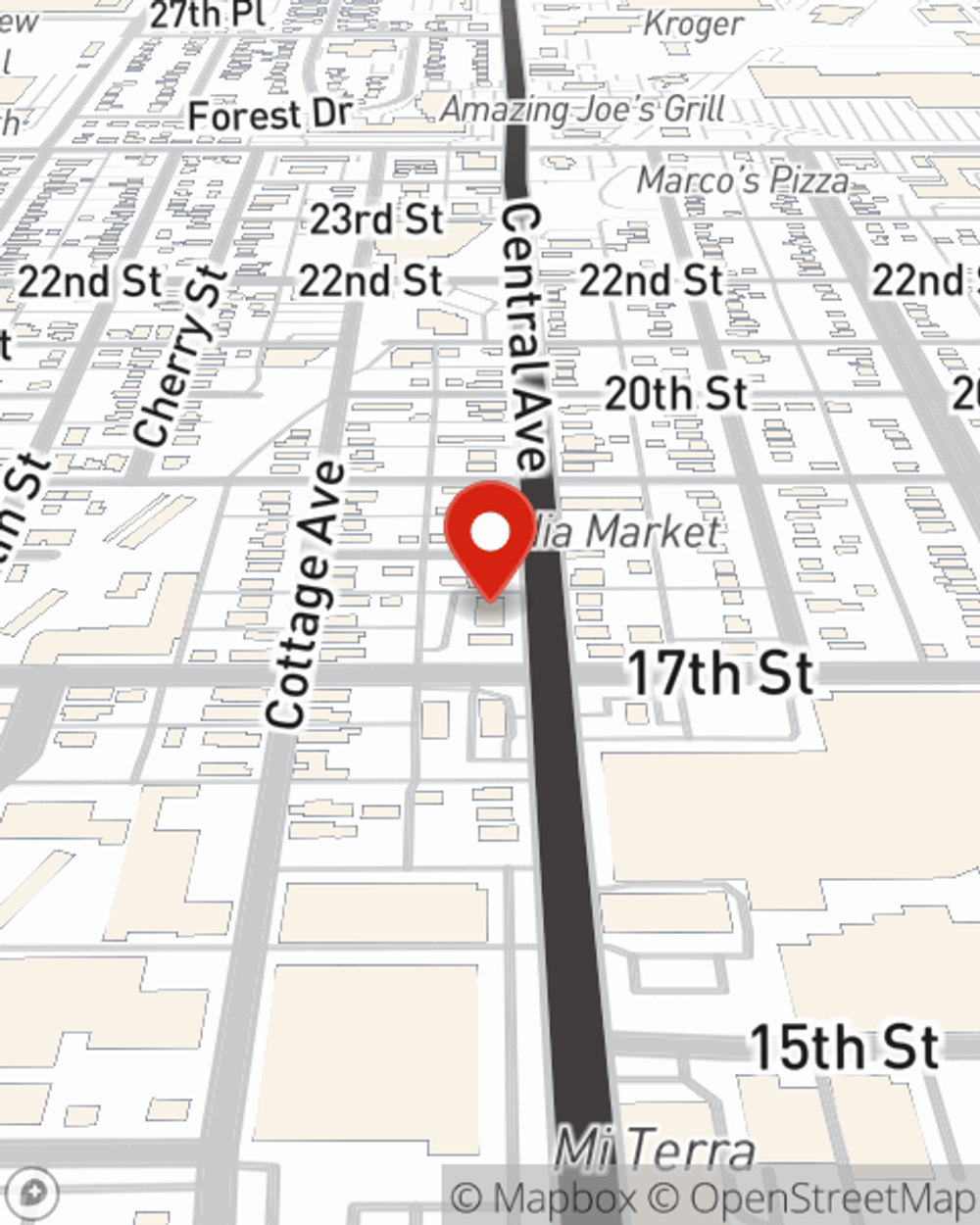

Business Insurance in and around Columbus

One of Columbus’s top choices for small business insurance.

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

You may be feeling like there is so much to do with running your small business and that you have to handle it all on your own. State Farm agent Bob Parker, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

One of Columbus’s top choices for small business insurance.

Cover all the bases for your small business

Get Down To Business With State Farm

If you're looking for a business policy that can help cover equipment breakdown, accounts receivable, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

It's time to call or email State Farm agent Bob Parker. You'll quickly uncover why State Farm is the reliable name for small business insurance.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what that is and how you can be ready.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Bob Parker

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what that is and how you can be ready.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.